Page 31 - UNANET GOVCON:

CLOSING A FISCAL PERIOD

P. 31

LESSON 4: GENERAL LEDGER

Learning Objectives

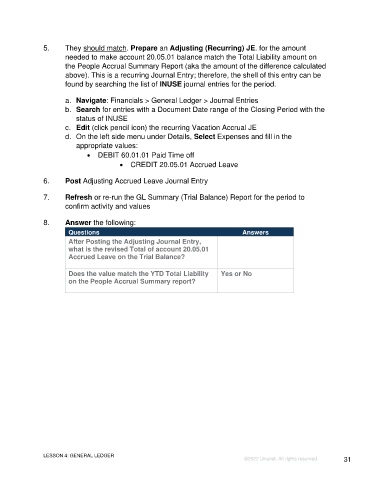

• Recognize the requirements and decisions involved to perform, validate, record,

and post various closing transactions

o Prepare, Validate, Record, and Post GL transactions

• Journal Entries

▪ Record Recurring Journal Entry for Payroll

▪ Reconcile Accrued Leave

▪ Record Adjusting Journal Entry for Accrued Leave

• Fixed Assets to recognize Depreciation Expenses

o Perform and Post Cost Pool Calculations

▪ Review indirect rates on the Statement of Indirect Rates

▪ Update Indirect Rates in the Cost Structure

• Differentiate the various procedures and options used to verify, reconcile, and

close Unanet’s Posting Features

o Close Posting Features for General Ledger

• Accounts Payable Revaluation (if applicable)

• Accounts Receivable Revaluation (if applicable)

• Cost Pool Post

• Fixed Asset Post

• Intercompany Post (if applicable)

• Journal Entry

Introduction

The Posting Feature for General Ledger consists of the Multi-Currency Revaluations,

Cost Pool Post, Fixed Asset Post, Intercompany Post, and Journal Entry. All

transactions for these areas must be entered, validated, and posted prior to closing the

Posting Feature for General Ledger.

Lesson 4 Overview Video (for SDL only)

Prepare And Post Journal Entries

The fiscal close process often requires the need to prepare and post recurring, accruals,

reversing, and adjusting journal entries according to GAAP (Generally Accepted

Accounting Principles) as needed. e.g., fees, prepaids, accruals, corrections, etc.

LESSON 4: GENERAL LEDGER Page 31

©2025 Unanet. All rights reserved.